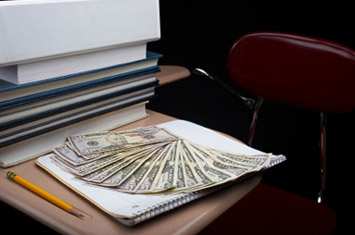

College Money Matters

College is often the first time that young people are responsible for managing their own finances. Read on to learn how to be smart with your money and how to develop good financial habits that will last a lifetime.

It is not uncommon for students to live beyond their means. Eating out too often, spending too much on video games, or dating too frequently all carry costs that can accumulate quickly. Taking the time to establish a budget can alleviate money problems and help develop good, lifelong money management skills. While establishing a budget may seem fairly easy, sticking to it is another story.

Food

Students, particularly those living in dorms without full kitchens, are often tempted to go out with friends each night rather than cook at home. Spending too much money on burgers and fries at the beginning of the month, however, may mean lonely macaroni and cheese or ramen dinners near the month's end. This can be avoided, however, if you plan ahead. Stock up on affordable convenience items to enjoy at home, such as pasta or eggs. If you live with roommates, establish a shopping and cooking rotation so that expenses are evenly extended. This will help make room in your budget to go out with friends every Friday night and have something to look forward to.

Credit Cards

College students are bombarded with tempting offers from credit card companies. While it can be useful to have a credit card for emergencies, using it for unnecessary items like CD's or video games can be hazardous. Debt can accumulate quickly and you can find yourself in over your head before you realize it. Always review the terms of a credit card before accepting it, and then only use it sparingly. A good rule of thumb is to not charge anything to your credit card that you cannot pay off in full at the end of the month.

Money matters are a stressful part of the college experience. You can help prevent and alleviate such stress, however, by entering school prepared to handle your own finances. Establishing a budget, distributing funds evenly from one week to the next, and using credit cards wisely are all effective methods of establishing a strong financial foundation.

Other Articles You May Be Interested In

-

For-Profit Teacher Certification: Money Over Quality?

As for-profit teacher certification programs have grown in popularity, their standards and methods are coming under heightened scrutiny. Are these programs more interested in producing high quality teachers or a profit? It may be difficult to decide.

-

Kids Money Issues

Does it always seem like there's lots you want to buy, but you don't get enough allowance to pay for it all? Keep reading to learn about how you can budget your spending money while still saving some for a rainy day!

We Found 7 Tutors You Might Be Interested In

Huntington Learning

- What Huntington Learning offers:

- Online and in-center tutoring

- One on one tutoring

- Every Huntington tutor is certified and trained extensively on the most effective teaching methods

K12

- What K12 offers:

- Online tutoring

- Has a strong and effective partnership with public and private schools

- AdvancED-accredited corporation meeting the highest standards of educational management

Kaplan Kids

- What Kaplan Kids offers:

- Online tutoring

- Customized learning plans

- Real-Time Progress Reports track your child's progress

Kumon

- What Kumon offers:

- In-center tutoring

- Individualized programs for your child

- Helps your child develop the skills and study habits needed to improve their academic performance

Sylvan Learning

- What Sylvan Learning offers:

- Online and in-center tutoring

- Sylvan tutors are certified teachers who provide personalized instruction

- Regular assessment and progress reports

Tutor Doctor

- What Tutor Doctor offers:

- In-Home tutoring

- One on one attention by the tutor

- Develops personlized programs by working with your child's existing homework

TutorVista

- What TutorVista offers:

- Online tutoring

- Student works one-on-one with a professional tutor

- Using the virtual whiteboard workspace to share problems, solutions and explanations